The cost of Ghana’s financial sector clean-up could increase to GH¢34 billion, following a parliamentary recommendation for the government to settle 61,000 customers of the defunct Gold Coast Fund Management.

This decision comes after these customers petitioned Parliament, prompting a Special Committee investigation.

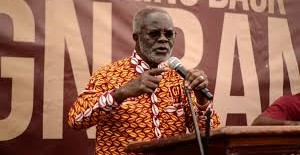

Joe Ghartey, Chairman of the Special Committee, addressing the House on Thursday, stressed the government’s obligation to honour its promise to repay the investors.

“We urge the government to do its part in terms of prosecuting the matter and following it in court so that the question of whether they should be liquidated or not will come to an end so that further payments can be made,” he stated.

This new expenditure of GH₵9 billion adds to the GH₵25 billion already spent on the clean-up exercise, as noted by former Finance Minister Ken Ofori-Atta.

To prevent future financial burdens on the state, the Committee recommended the incorporation of insurance in all financial decisions.

“We recognize the fact that this House passed the Ghana Deposit Protection Act 2016, and it was passed to protect depositors. We cannot continue at this rate where people set up financial institutions and then they collapse, leaving the government as the last resort,” Mr Ghartey remarked.

He suggested that insisting on insurance for such investments could alleviate the government’s role as a guarantor between financial institutions and citizens.