In the name of God, the compassionate the merciful

Ghana stands at a pivotal moment in its economic journey. With a growing population, a vibrant entrepreneurial spirit, and a strategic position in West Africa, the nation is poised to become a regional leader in innovation and development. However, to fully realize this potential, Ghana must embrace financial systems that are inclusive, ethical, and sustainable. Enter Islamic finance—a rapidly growing global phenomenon that aligns with Ghana’s cultural values and economic aspirations. As the Bank of Ghana prepares to discuss the implementation of Islamic finance, it is time to explore how this system can serve as a catalyst for inclusive growth and financial inclusion.

The Ethical Appeal of Islamic Finance

At its core, Islamic finance is built on principles that prohibit riba (interest), gharar (excessive uncertainty), and investments in industries deemed harmful to society, such as gambling or alcohol. Instead, it promotes risk-sharing, asset-backed financing, and ethical investments. These principles resonate deeply with Ghanaian values, which emphasize fairness, community, and social responsibility.

For many Ghanaians, particularly those in Muslim-majority communities, conventional banking has been inaccessible due to religious or cultural reservations. Islamic finance offers an alternative that aligns with their beliefs, while also appealing to non-Muslims who are drawn to its ethical and transparent approach. By adopting Islamic finance, Ghana can tap into a vast, underserved market, fostering greater participation in the formal financial system.

Driving Financial Inclusion

One of the most pressing challenges in Ghana’s financial sector is the lack of access to banking services, especially in rural and low-income areas. According to the World Bank, nearly 40% of Ghana’s population remains unbanked. Islamic finance, with its emphasis on inclusivity and social impact, can play a transformative role in bridging this gap.

Islamic microfinance, for instance, provides interest-free loans to small businesses and entrepreneurs, enabling them to grow and contribute to the economy. Similarly, Islamic savings and investment products can empower low-income households to build wealth and secure their futures. Countries like Nigeria and Kenya have already demonstrated the potential of Islamic finance to drive financial inclusion, and Ghana can follow suit.

Attracting Foreign Investment

The global Islamic finance industry is valued at over $3 trillion and continues to grow rapidly. By adopting Islamic finance, Ghana can position itself as a gateway for investment from the Gulf Cooperation Council (GCC) countries and other Islamic markets. Sukuk (Islamic bonds), for example, have been used successfully in countries like Senegal and South Africa to fund infrastructure projects, from roads to hospitals.

For Ghana, sukuk could provide a much-needed source of capital to address its infrastructure deficit, stimulate economic growth, and create jobs. Moreover, the ethical and transparent nature of Islamic finance makes it an attractive option for socially responsible investors worldwide.

Economic Diversification and Stability

Ghana’s economy has traditionally relied on conventional banking and resource-based industries, leaving it vulnerable to external shocks. Islamic finance offers an opportunity to diversify the financial sector, creating a more resilient and dynamic economy.

Unlike conventional banking, which often prioritizes short-term profits, Islamic finance emphasizes long-term stability and shared risk. This approach encourages sustainable investments in sectors like agriculture, renewable energy, and healthcare, which are critical to Ghana’s development. By integrating Islamic finance into its financial ecosystem, Ghana can build a more inclusive and stable economy that benefits all citizens.

Building a Robust Regulatory Framework

The successful implementation of Islamic finance in Ghana will require a strong regulatory framework that ensures transparency, accountability, and consumer protection. The Bank of Ghana, in collaboration with other stakeholders, must develop guidelines for Sharia-compliant products, establish oversight bodies, and train professionals in Islamic finance.

Countries like Malaysia and the United Kingdom have shown that a supportive regulatory environment is key to the growth of Islamic finance. By learning from these examples, Ghana can create a framework that fosters innovation while safeguarding the interests of all stakeholders.

A Tool for Sustainable Development

Islamic finance is not just about economic growth—it is also about social impact. By aligning with the United Nations Sustainable Development Goals (SDGs), Islamic finance can help Ghana address pressing challenges like poverty, inequality, and climate change.

For example, Islamic social finance tools such as zakat (charitable giving) and waqf (endowments) can be used to fund education, healthcare, and community development projects. Similarly, green sukuk can support investments in renewable energy and environmental conservation, helping Ghana transition to a greener economy.

Conclusion: A Call to Action

The implementation of Islamic finance in Ghana is not just a financial decision—it is a strategic move that can unlock the nation’s economic potential and improve the lives of millions. By embracing this ethical and inclusive system, Ghana can attract investment, drive financial inclusion, and build a more resilient economy.

The time has come for stakeholders—government agencies, financial institutions, and the private sector—to come together and create an enabling environment for Islamic finance. With the right policies and partnerships, Ghana can position itself as a regional leader in ethical and sustainable finance, setting an example for other nations to follow.

As Ghanaians eagerly await the Bank of Ghana’s beginning of discussions on implementing this transformative initiative, let us seize this opportunity to build a brighter, more inclusive future for all. Islamic finance is not just a tool for economic growth—it is a pathway to shared prosperity and sustainable development. And Allah knows best!

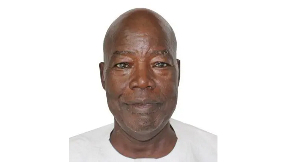

YAHAYA ILIASU MUSTAPHA

The writer is the Ghana representative of the Alhuda Centre of Islamic Banking and Economics, Dubai, and Islamic Banking and Finance patron and advocate in Ghana. He is also the founder of ‘Islamic Finance TV Gh’ on Facebook, TikTok, and YouTube. He holds a BSc. in Islamic banking, economics, and finance from the International Open University a BA. in Political Science from the University of Ghana, and a Diploma in Education from the University of Winneba. We would want to collaborate and partner with any persons or organizations who are willing to explore this field in Ghana and beyond.

Email: yahaya0246873726@gmail.com

https://www.facebook.om/Yahaya.iliasu.94

0506218343 / WhatsApp 0246873726