Three senior Members of Parliament from the New Patriotic Party (NPP) caucus have warned the government about recent policy decisions that they claim could have devastating consequences for the mining sector, investor confidence, and the broader economy.

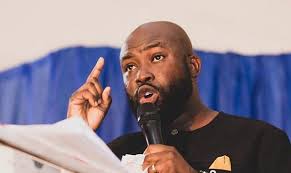

In a joint letter addressed to the Minister for Finance and the Minister for Lands and Natural Resources, Hon. Kojo Oppong Nkrumah, Hon. Kwaku Ampratwum Sarpong, and Hon. Dr. Mohammed Amin Adam—ranking members on the Parliamentary Committees on the Economy, Lands and Natural Resources, and Finance respectively—expressed serious concern over what they describe as “potentially dire consequences” of recent government actions.

The MPs argue that the cumulative impact of tax hikes, restrictive legislation, lease non-renewals, and abrupt policy shifts in the gold mining sector is severely undermining investor confidence, especially among foreign direct investors (FDIs).

The three cited the imposition of two new levies introduced as part of the government’s 2025 revenue policies: a 2% growth and sustainability levy on gross mining volumes, and a further levy set to span from 2026 to 2028.

According to them, these levies operate similarly to royalties and disproportionately impact mining operations, particularly those already in financial distress or involved in non-booming mineral extractions.

“The combined effect of these royalty-like levies is that it is putting several mines already in distress into graver financial difficulties. It has further created uneven financial burdens in the sector for companies mining other minerals that have not experienced a price boom,” the MPs noted.

The industry, through the Ghana Chamber of Mines, has reportedly called for engagements with the government to explore more sustainable and efficient alternatives to these levies. However, the MPs fear the government is yet to respond adequately.

The second issue raised was the enactment of the GOLDBOD Act, which among other provisions, prohibits foreign investors from participating in gold trading and export. The MPs argue that this legislation not only ignores the input of stakeholders but also contradicts Ghana’s Constitution.

“Section 78(4) of the GOLDBOD Act appears to be in breach of Article 107(b) of the 1992 Constitution. It retrospectively takes away rights that have accrued to foreign investors who operate in the gold trading industry,” they stated.

They claim the bill was “rushed through” Parliament, ignoring concerns raised by the Minority and industry stakeholders, and sends a signal that could deter potential investors due to fears of expropriation and regulatory unpredictability.

The letter further condemned the recent rejection of a mining lease renewal application by Goldfields Ghana Limited, describing the move as “a signal to investors to pack out of the said operation.” They argue that instead of outright rejection, government should have used the opportunity to renegotiate terms that could favor the country.

The Minority MPs also criticized the policy decision to defund 80% of inflows into the Minerals Income Investment Fund (MIIF)—a fund previously used to invest in new mining concessions. The move, they say, implies the state is withdrawing its commitment to participate in mining ventures, effectively signaling a lack of confidence in the sector to potential investors.

Adding to the economic and legal concerns are issues of physical safety and the resurgence of illegal mining (galamsey). The MPs underscored a recent violent attack on a mine that led to the death of eight individuals. According to them, inflammatory public rhetoric and stalled investigations have worsened fears among investors.

“The decision to abolish Community Mining Schemes further opens the door to galamsey activities. Rather than banning the schemes outright, government should have reformed and corporatized them,” they warned.

The ban, they argued, has not only led to increased illegal mining but also removed a community-level intervention that had the potential to create sustainable local employment in mining communities.

The MPs argued that the cumulative effect of these decisions within a short three-month period is creating a hostile environment for investors. They stress that Ghana, at a time of limited domestic investment can ill afford to alienate foreign capital.

“The recent levies on the industry deepen the perception that fiscal measures may be abruptly changed to the detriment of investors. These measures will increase the risk of operating losses and job losses, with very negative consequences on lives and livelihoods,” they said.

The letter underscores that such abrupt and aggressive policies could have far-reaching impacts on the country’s economic outlook, potentially undermining efforts to stabilize the economy and attract much-needed capital inflows.

The MPs issued a direct appeal to the government to reverse or reconsider many of its recent actions. They outlined specific recommendations, including:

- Immediate renewal of pending lease applications to protect existing investments.

- Introduction of fiscal incentives to stimulate new investment in the sector.

- Avoidance of hostile rhetoric that could incite violence or deepen mistrust between the government and the investor community.

- Enhanced engagement with investors to promote corporate social responsibility and development in mining communities.

- Establishment of a clear and transparent framework for transitioning Ghanaian companies from small-scale to larger-scale mining operations as a long-term solution to illegal mining.

“The Government’s actions will have a significantly negative impact on the investment climate and economic outlook. This is the time when you need to bolster economic stability and attract, rather than discourage, Foreign Direct Investments into the economy,” the MPs warned.