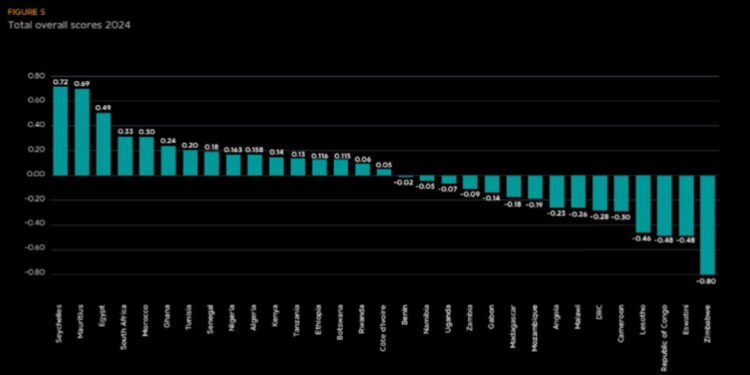

With an overall index score of 0.24, Ghana is Africa’s 6th most investable country, according to the 2024 edition of the Rand Merchant Bank Where to Invest In Africa Report.

This is despite the 0.24 index score being lower than the previous year’s index score 0.31.

The ranking by RMB is based on the assessment of four pillars which are; economic performance and potential, market accessibility and innovation, economic stability and investment climate, and social and human development.

Per the report, Ghana, which is West Africa’s second-largest economy ranked third on the social & human development index; ranked 8th in economic stability & investment climate, 6th in market accessibility & innovation and 15th in economic performance & potential.

The country lagged behind peers such as Seychelles, Mauritius, Egypt, South Africa and Morocco.

According to RMB, discounting the two highly desirable but tiny islands of Seychelles and Mauritius, Ghana is the fourth most investable country in our model, behind Egypt, South Africa, and Morocco.

With a GDP of $76bn and a population of some 33.5 million people, Ghana represents a substantial market. Further, it is among the top ten for urbanization, connectedness, innovation, political stability, personal freedom, and employment.

Ghana also ranks favourably on corruption and tops the list on import concentration.

Critical to the country’s macroeconomic stability, the report asserts, is addressing high public debt and inflation, particularly against the backdrop of a three-year US$3bn extended credit facility (2023-26) programme with the IMF.

“There are positive signs on the fiscal front. Fiscal consolidation is broadly on track, with an estimated deficit of 4.6% of GDP at the end of 2023, significantly lower than the 10.7% deficit in 2022. At 15.7% of GDP in 2023, revenues and grants reached the same level as in 2022 despite lower oil revenues. By 2027, growth is forecast to benefit from increased gold and oil exports as new projects come online,” noted the report.

Despite being one of the smallest economies on the continent, Seychelles topped the list of investable places in Africa. The nation topped metric scores on personal freedom, human development, lack of corruption, and connectedness.

Mauritius ranked next in social & human development, economic stability & investment climate, while it ranked 3rd in market accessibility & innovation and 23rd in economic performance & potential.

While Egypt ranked 3rd overall, it ranked first in economic performance & potential. It however ranked 5th in market accessibility & innovation, 23rd in economic stability & investment climate, and 13th in social & human development.

South Africa ranked 4th best African country to invest in 2024. It ranked first in market accessibility & innovation, 5th in economic performance & potential, 7th in economic stability & investment climate, and 29th in social and human development.

Morocco ranked 5th best place to invest in Africa. It also ranked 5th in social & human development, 20th in economic stability & investment climate, 27th in market accessibility & innovation, and 25th in economic performance & potential.

The RMB Where to Invest in Africa reportassessed 31 countries drawing on 20 different metrics made up of rich data spanning four measurement pillars. The data covers everything from GDP per capita to human development drawing on publicly available data sets from global institutions, including the World Bank, the IMF, the African Development Bank, the United Nations, and the International Labour Organisation.