Co-chair of the Ghana Extractive Industry Transparency Initiative (GHEITI), Dr Steve Manteaw, says investors are currently not interested in Ghana’s oil and gas sector.

His assertion is premised on the country’s inability to attract investors to bring into production a single oil field since 2017 despite having undertaken a number of competitive bidding rounds for the country’s oil blocks.

Additionally, investors have described Ghana’s investment environment as “increasingly hostile” for which they are reluctant to invest in the country.

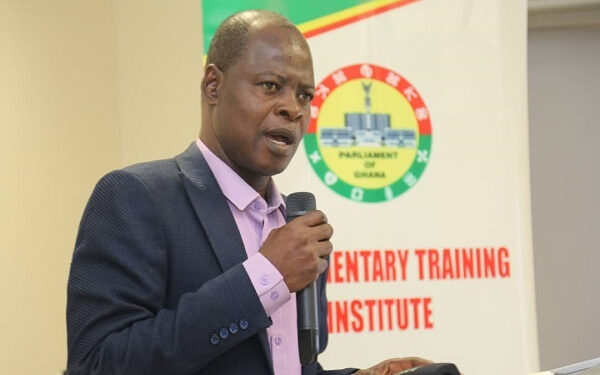

“Investors are not interested in Ghana’s oil sector and that is why you see very little to no investments in the sector, the GNPC now spends millions of dollars on roadshows to attract investments into the oil sector but the investments don’t materialize and if they do their homework well, they would know why investors are not willing to invest in the country’s oil sector,” he quipped.

He made the assertion while speaking at the Ghana Extractive Industry Transparency Initiative (GHEITI) Technical Workshop for Journalists on the 2021/2022 GHEITI Reports on the Mining, Oil and Gas sectors.

The objective of the Technical Workshop with journalists was to build the capacity of the media on key issues in the 2021/2022 GHEITI Reports in particular and broaden their understanding and knowledge in the extractive sector in general.

According to Dr Manteaw, regulatory uncertainty, low-quality oil exploratory data and disputes with investors – the case of unitization arbitration with Eni – are among the major reasons for the unattractiveness of the country’s oil sector to investors.

“Indeed the then Deputy Minister of Energy, who is now the Finance Minister – Dr Mohammed Amin Adam – admitted in a meeting with CSOs that our data quality is nowhere near what we need to attract investments. So what do we do? We have to invest in data-gathering systems and get more data that can make our oil sector more attractive. But we haven’t done any of this. There are other areas that we also need to look at but we haven’t and rather we keep going on these roadshows hoping to attract investments,” he observed.

Per the report, the mining sector’s contribution to the country’s GDP declined from GHS 11.4bn in 2020 to GHS 10.1bn in 2021 representing a decrease of 11.7%.

It, however, increased to GHS 13.02bn in 2022 representing a 28.9% jump.

For the oil and gas sector, the sector contributed 4.89% to GDP which accounted for 6.91% of total Government revenue and 7.03% of domestic revenue in 2021.

The report noted that a total of 11.6 million barrels of crude oil was exported by the GNPC for an amount of $496m while other partners such as Eni and Tullow exported 55.8 million barrels of crude oil in 2022.

Thus, the total crude oil exports for 2022 were 67.4 million barrels valued at $2.91bn.

The Ghana Extractive Industry Transparency Initiative (GHEITI) on June 30, 2024, published its 2021 – 2022 reconciliation reports for mining, oil and gas. The publication brings to 29, the total number of reports published since Ghana acceded to the initiative, made up of 18 mining and 11 oil and gas reports.