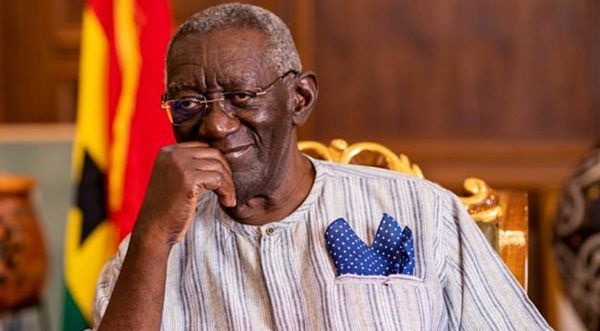

Former President John Agyekum Kufuor has urged Ghanaians to unite in the battle against tax revenue leakages, describing the issue as a defining challenge for Ghana’s economic sovereignty.

In a keynote address delivered on his behalf by Dr. James Kwabena Bomfeh Jnr. at the National Tax Dialogue organized by the University of Professional Studies, Accra (UPSA) on Monday, Mr. Kufuor called for a blend of technology, transparency, and political will to safeguard national revenues.

The former president emphasized that tax revenue leakages, fueled by corruption and mismanagement, are crippling Ghana’s ability to deliver essential services to its people.

“When a nation fails to collect the required revenues or loses collected taxes to thieves, corruption, and mismanagement, it will fail to provide responsive service to its people,” he stated.

President Kufuor recounted efforts to streamline revenue collection and reduce loopholes through institutional reforms and digitization.

“We streamlined and modernized tax collection by unifying all the revenue agencies under the Ghana Revenue Authority (GRA) and laid the foundation to digitize our system,” he noted.

He stressed that broadening the tax base—not overburdening existing taxpayers—is the key to sustainable revenue growth.

He said tax is not about squeezing more out of the same base by raising rates but rather about broadening the base, enhancing compliance, and fostering growth.

The former President advocated for greater investment in digital infrastructure to tackle revenue leakages and monitor transactions in real-time.

“Technology represents what we need in minimizing manual intervention. It seals off many of the loopholes that leak revenue,” he said.

He cited automated systems such as real-time fuel volume tracking as examples of how technology can be used to prevent tax evasion.

President Kufuor lamented that many Ghanaians are discouraged from paying taxes due to a lack of accountability and visibility on how funds are used.

According to him, many Ghanaians feel reluctant to pay taxes when they are unsure of where the money will go and charge the government to be open about tax collection and expenditure, report on projects, celebrate successes and admit shortcomings.

He argued that a virtuous cycle of transparency leads to improved compliance and ultimately higher revenue.

The former president also urged sustained public education on taxation, emphasizing that tax awareness campaigns should not be one-off events.

He stressed that citizen engagement and taxpayer education should be a continuous conversation so citizens should know about how their taxes are making a difference in their lives.

Mr. Kufuor expressed optimism that Ghana can meet its ambitious goal of reaching a 20% tax-to-GDP ratio—if reforms are consistent and inclusive.

“A Ghana that is self-sufficient is the only guarantee to safeguarding our sovereignty. Together, we can significantly increase our tax-to-GDP ratio not by burdening the few, but by empowering and encouraging all to contribute,” he declared

He called on every Ghanaian—whether professional, politician, or business owner—to become an ambassador for responsible tax practices.

The former president affirmed that the fight against tax revenue leakages is not just economic, but patriotic and stressed, “The fight against tax leakages is a fight for Ghana’s soul and future. Together, it is a fight we must win.”

The National Tax Dialogue brought together traditional leaders, policymakers, academics, and civil society actors in a spirited push for better governance of Ghana’s tax system.