Ghana stands at a critical juncture in its economic journey. With rising public debt, inflationary pressures, and a currency that continues to face challenges, the need for innovative and inclusive financial solutions has never been more pressing. Against this backdrop, our President’s promise to implement Islamic finance in Ghana during the election campaign must be revisited and acted upon urgently. Three months into the new administration, Ghanaians are still waiting for concrete steps toward this transformative initiative. The time to act is now.

Islamic finance, often misunderstood as a religious activity, is a robust and ethical financial system that has gained global recognition for its potential to foster economic stability, inclusivity, and growth. It is not merely a tool for Muslims; it is a system that can benefit all Ghanaians, regardless of their religious affiliations. By embracing Islamic finance, Ghana can tap into a $3 trillion global industry, attract foreign investment, and provide an alternative financing mechanism that aligns with the values of risk-sharing, transparency, and social responsibility.

What will Islamic finance proffer to the Ghanaian economy?

Diversification of the Financial Sector: The introduction of Islamic finance will diversify Ghana’s financial sector, offering new products such as Sukuk (Islamic bonds), Murabaha (cost-plus financing), and Mudarabah (profit-sharing agreements). These instruments can provide alternative funding sources for infrastructure projects, small and medium-sized enterprises (SMEs), and other critical sectors of the economy.

Attracting Foreign Investment: Many investors, particularly from the Middle East and Southeast Asia, are eager to invest in countries that offer Sharia-compliant financial products. By implementing Islamic finance, Ghana can position itself as a hub for Islamic investments in West Africa, boosting foreign direct investment (FDI) and creating jobs.

Financial Inclusion: Islamic finance emphasizes ethical banking and financial inclusion. It prohibits exploitative practices such as excessive interest (riba) and speculative activities (gharar). This makes it an attractive option for Ghanaians who have been excluded from the traditional banking system due to religious or ethical concerns.

Stabilizing the Economy: The principles of Islamic finance, such as risk-sharing and asset-backed financing, can contribute to financial stability. By reducing reliance on debt-based financing, Ghana can mitigate some of the risks associated with its current economic challenges.

A Call to Action for the President, Finance Minister, and Bank of Ghana

To the President, His Excellency John Dramani Mahama: Your promise to implement Islamic finance resonated with many Ghanaians who saw it as a forward-thinking approach to economic reform. Now is the time to honor that promise. The implementation of Islamic finance should be viewed not as a religious activity but as a strategic economic measure to salvage and revitalize Ghana’s economy. We urge you to prioritize this initiative and provide the necessary leadership to ensure its success.

To the Finance Minister, Dr. Cassiel Ato Forson: The Ministry of Finance plays a pivotal role in shaping Ghana’s economic policies. The implementation of Islamic finance requires your expertise and commitment. We call on you to initiate the necessary legislative and regulatory reforms to create an enabling environment for Islamic finance to thrive. This includes amending existing laws, such as the Banking Act, to accommodate Sharia-compliant financial products.

To the Governor of the Bank of Ghana, Dr. Johnson Pandit Asiama: The Central Bank’s role in regulating and supervising the financial sector is crucial. We urge you to collaborate with stakeholders, including Islamic finance experts, to develop a robust regulatory framework for Islamic banking and finance. Training programs for bankers and financial institutions should also be introduced to build capacity and ensure the smooth rollout of Islamic finance products.

Moving Forward: Practical Steps for Implementation

Establish a Task Force: A dedicated task force comprising experts in Islamic finance, policymakers, and industry stakeholders should be set up to oversee the implementation process.

Legislative Reforms: Amend existing laws and regulations to accommodate Islamic finance products and ensure they are treated on par with conventional financial instruments.

Public Awareness Campaigns: Educate Ghanaians about the benefits of Islamic finance to dispel misconceptions and encourage widespread adoption.

Pilot Programs: Launch pilot Islamic banking and finance products in collaboration with existing banks to test the market and gather feedback.

International Collaboration: Partner with countries that have successfully implemented Islamic finance, such as Malaysia, Indonesia, and the UAE, to learn from their experiences and attract investment.

I a nutshell, the implementation of Islamic finance in Ghana is not just a promise to be fulfilled; it is an economic imperative. It offers a unique opportunity to diversify our financial sector, attract investment, and promote financial inclusion. The President, the Finance Minister, and the Bank of Ghana must act now to ensure that this initiative becomes a reality. Let us view Islamic finance not through the lens of religion but as a powerful tool to salvage and transform Ghana’s economy for the benefit of all citizens. The time for action is now. Ghana cannot afford to wait any longer. And Allah knows!

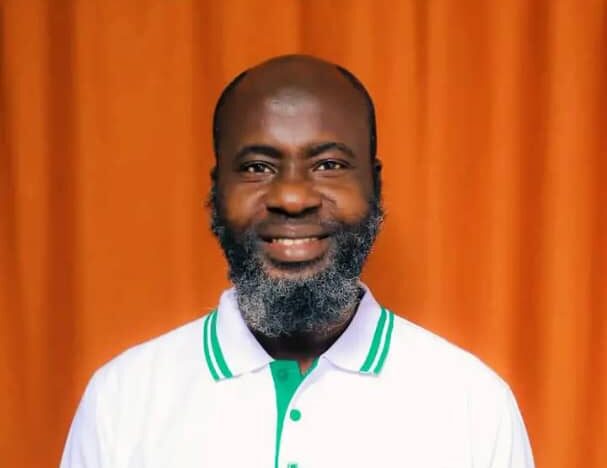

YAHAYA ILIASU MUSTAPHA

The writer is the Ghana representative of the Alhuda Centre of Islamic Banking and Economics, Dubai, and Islamic Banking and Finance patron and advocate in Ghana. He is also the founder of ‘Islamic Finance TV Gh’ on Facebook, TikTok, and YouTube. He holds a BSc. in Islamic banking, economics, and finance from the International Open University, a BA in Political Science from the University of Ghana, and a Diploma in Education from the University of Winneba. We would want to collaborate and partner with any persons or organizations who are willing to explore this field in Ghana and beyond.

Email: yahaya0246873726@gmail.com

https://www.facebook.om/Yahaya.iliasu.94

0506218343 / WhatsApp 0246873726